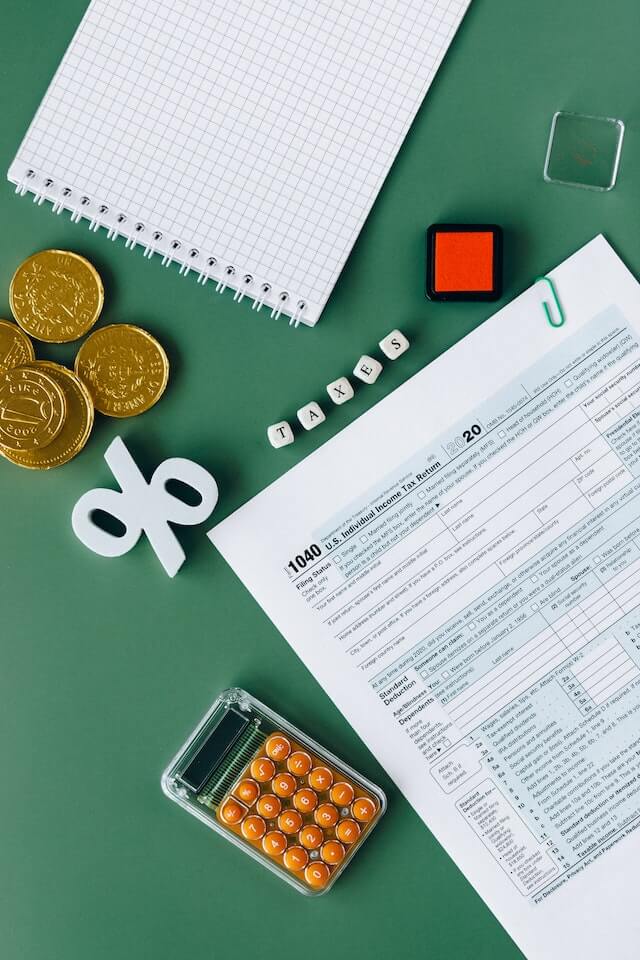

Setting up an effective bookkeeping system is crucial for the financial success of your business. A well-organized system helps you track income, expenses, and cash flow, ensuring accurate financial records and informed decision-making. In this blog post, we will provide a beginner's guide to setting up an effective bookkeeping system, helping you streamline your financial processes and gain better control over your business's finances.

1. Choose the Right Accounting Software:

The first step in setting up your bookkeeping system is selecting the right accounting software. Look for software that suits the size and needs of your business. Popular options include QuickBooks, Xero, and FreshBooks. Consider factors like user-friendliness, features, integrations, and pricing to make an informed decision.

2. Set Up Your Chart of Accounts:

A chart of accounts is a list of categories or accounts used to classify your income, expenses, assets, liabilities, and equity. Customize your chart of accounts to align with your business's specific needs. Common account categories include revenue, cost of goods sold, operating expenses, and assets like cash, accounts receivable, and inventory.

3. Establish a Filing System:

Create a filing system to organize your financial documents and records. Use physical or digital folders for invoices, receipts, bank statements, and other relevant documents. Organize them chronologically or categorically, making it easy to locate specific documents when needed. Consider using cloud storage for secure and accessible digital filing.

4. Track Income and Expenses:

Consistently record all income and expenses in your accounting software. Set up separate accounts or categories for different types of income and expenses. Be diligent about entering data accurately and in a timely manner. Regularly reconcile your bank accounts and credit card statements to ensure accuracy and identify any discrepancies.

5. Implement a Regular Reconciliation Process:

Reconciliation involves comparing your accounting records with bank statements to ensure they match. This process helps identify errors, omissions, or fraudulent activities. Perform bank reconciliations monthly, ensuring that all transactions are accounted for and any discrepancies are resolved promptly.

6. Create a Budget:

Developing a budget is essential for effective financial planning. It allows you to set revenue and expense targets, monitor your progress, and make adjustments as needed. Use historical data from your bookkeeping system to create realistic revenue projections and allocate funds for various expenses.

7. Monitor Cash Flow:

Maintaining a positive cash flow is vital for business sustainability. Use your bookkeeping system to track incoming and outgoing cash, identify cash flow patterns, and anticipate potential shortfalls. Regularly review your cash flow statements to make informed decisions about managing expenses and ensuring sufficient working capital.

8. Schedule Regular Financial Reviews:

Schedule regular financial reviews to assess the health of your business. Analyze financial statements such as balance sheets, income statements, and cash flow statements. Look for trends, variances, and areas of improvement. These reviews help you identify opportunities for growth, cost-saving measures, and potential financial risks.

9.Consider Professional Help:

If you're unsure about setting up your bookkeeping system or find it overwhelming, consider seeking professional help. An accountant or bookkeeper can assist you in establishing a robust system, ensuring compliance with tax regulations, and providing valuable financial insights.

10. Stay Updated and Seek Continuous Learning:

The field of bookkeeping and accounting is constantly evolving. Stay updated with changes in tax laws, accounting standards, and technology. Seek continuous learning opportunities to enhance your bookkeeping skills and make the most of your system's capabilities.

Setting up an effective bookkeeping system is a fundamental step in managing your business's finances

and ensuring long-term success. By following this beginner's guide, you can establish a solid foundation

for accurate financial record-keeping and gain valuable insights into your business's financial health.

Remember to choose the appropriate bookkeeping method, set up a chart of accounts, leverage

bookkeeping software, establish a regular recording schedule, and organize your financial documents.

Regularly reconciling bank and credit card statements, tracking income and expenses, and monitoring

cash flow will provide you with the necessary information to make informed decisions and drive your

business forward.

Implementing an effective bookkeeping system may require some initial effort, but the benefits it

provides are well worth it. With accurate financial records, you can evaluate your business's

performance, identify areas for improvement, and ensure compliance with legal and tax obligations. If

you find yourself struggling or facing complex financial situations, don't hesitate to seek assistance

from

a professional bookkeeper or accountant. They can provide expert guidance and help you optimize your

bookkeeping processes.

Remember, an effective bookkeeping system is not only about recording transactions—it's about gaining

a clear understanding of your business's financial position, making informed decisions, and driving your

business toward growth and success. By implementing the practices outlined in this guide, you'll be on

your way to setting up an effective bookkeeping system that serves as a valuable tool for your business's

financial management.